A trading platform that enables trading of all financial instruments in the world

Login Contact Us Open Account

Open Account

FXCA offers 1x, 10x, 25x, 50x, 100x, 200x, 2000 times leverage.

Maximum leverage depends on account type and trading product, so be sure to check the leverage details before trading.

In addition, FXCA protects customers’ valuable funds from the risk of sudden price fluctuations caused by the economic conditions of each country and the world situation.

Leverage restrictions may be temporarily set with prior notice.

In addition, in order to avoid a large risk of loss due to high leverage, we have set a leverage limit based on the customer’s margin balance.

Leverage fluctuates when a certain margin balance is exceeded as shown in the table below.

| Margin balance | 1 leverage ratio |

●leverage ratio |

●leverage ratio |

●leverage ratio |

●leverage ratio |

●leverage ratio |

●leverage ratio |

●leverage ratio |

|---|---|---|---|---|---|---|---|---|

| $0~$100,000 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 |

| $100,001~$200,000 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 |

| $200,001〜$300,000 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 |

| above $300,001 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 |

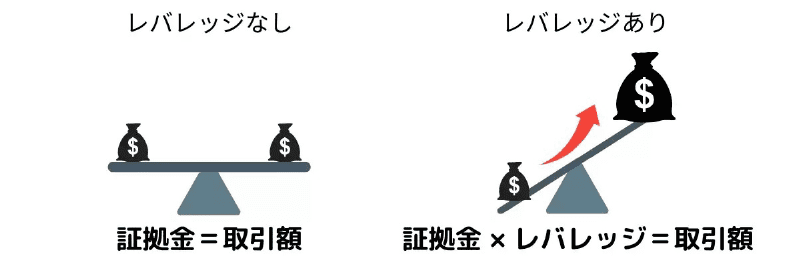

Leverage means a “lever” that lifts a large object with a small force.

The leverage of Japanese personal accounts is limited to 25 times by the FSA’s leverage regulation.

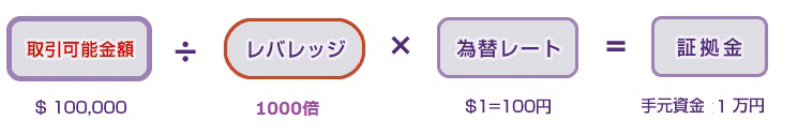

For example, if you trade 10 million yen, the margin will be 10 million yen if there is no leverage.

If you multiply this by 1000 times the leverage, you can trade with a margin of only 10,000 yen.

It is no exaggeration to say that making such transactions is “leveraging” and this is the greatest feature of Forex.

Leveraging can give you bigger returns, but it also comes with great risks.

With high leverage, the transaction amount will fluctuate significantly even with small movements in the market.

If the market price fluctuates in an unfavorable direction, the loss may increase and forced settlement may occur.

If the leverage is 10 times, the return will be 10 times, but the loss may be 10 times as much,

Overseas Forex tends to be shunned because of its high risk.

However, I understand that leverage is not for trading many times the margin, but for trading with a small margin.

It is important to control the risk and trade.

FXCA has introduced a zero cut system to protect customers from the risk of sudden price fluctuations.

Therefore, even if the account balance becomes negative, the zero cut will be executed and no margin will be issued.