A trading platform that enables trading of all financial instruments in the world

Login Contact Us Open Account

Open Account

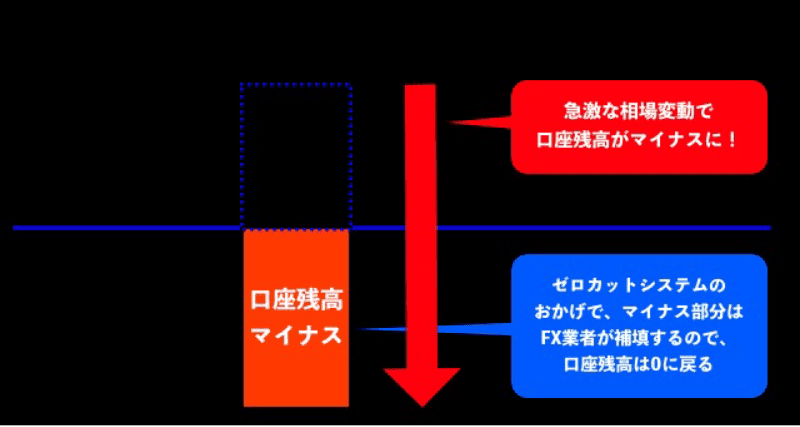

FXCA has introduced a loss cut and zero cut system to protect your valuable funds from the risk of debt.

If the loss cut is not in time due to sudden price fluctuations and the balance becomes negative, you do not need to pay additional margin.

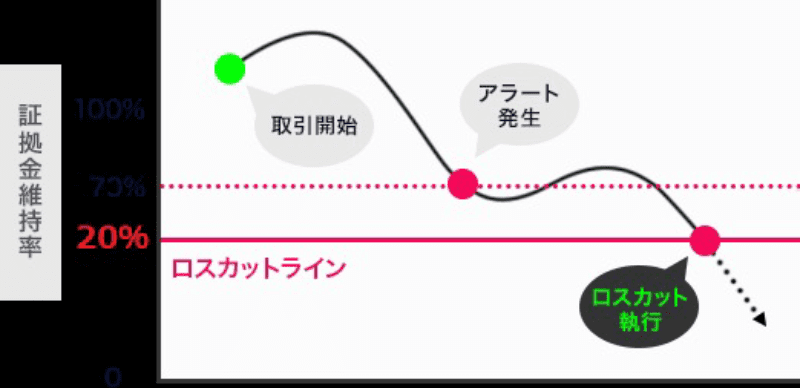

Margin call is activated when the margin retention rate in the trading account falls below 20%, and the profit and loss display column on the trading screen is displayed in red.

If the margin maintenance rate falls below 20%, the loss cut will be activated in order from the position with the largest unrealized loss regardless of the contract date and time.

Negative balances are usually reset within 1 hours, but if they are not reset after business days, please contact support.

| Number of lots (currency) | Unrealized loss | The order in which the loss cut is executed |

|

|---|---|---|---|

| Position A | October 1st xx: xx | October -10,000 yen | No. 2 |

| Position B | October 2, xx: xx | -30,000 yen | No. 1 |

| Position C | October 3, xx: xx | -2,000 yen | No. 3 |

Stop-loss is a system in which positions are automatically settled when a certain margin maintenance rate is reached, and it works to protect customers from the spread of losses.

The margin retention rate is a numerical value that indicates how much the effective margin has a margin for the required margin, and is calculated by the following formula.

Valid Margin: The amount that can be used for trading, including the profit and loss and bonus credit included in the balance.

Margin requirement: Margin required for entry, calculated as follows

Margin requirement = transaction size (basically 100,000 currencies in the case of Forex) x number of lots ÷ leverage

Margin retention rate formula

Margin retention rate = Effective margin ÷ Required margin x 100

For example, suppose that the required margin for a holding position is 10,000 yen, while the effective margin amount is 100,000 yen.

Applying the above formula, the margin retention rate at this time is 1000%.

The level of margin maintenance rate at which loss cuts are executed varies from trader to trader.

In the case of FXCA, the loss cut is set to be activated when this margin maintenance rate reaches ●%.

The lower this level, the longer you can hold a position and you can wait for the market to recover.

You can recover the margin retention rate by making an additional deposit to your trading account,

It is important to keep in mind the transactions that you can afford and control so that you do not fall into a loss cut.

Zero cut is a system in which the Forex trader compensates for the loss when the loss cut is not in time due to sudden fluctuations in the exchange rate.

Domestic Forex companies have not introduced this zero cut system, so they are obliged to pay margin (additional margin)

to cover the negative balance.

However, overseas Forex banks do not have to take the risk of debt exceeding the deposit amount because this margin does not occur.

It can be said that this is one of the great merits of using overseas Forex.