A trading platform that enables trading of all financial instruments in the world

Login Contact Us Open Account

Open Account

FXCA offers a variety of convenient and safe deposit methods, and also supports deposits in cryptocurrencies.

Regardless of the deposit method, FXCA will bear the deposit fee, so you can use it for free.

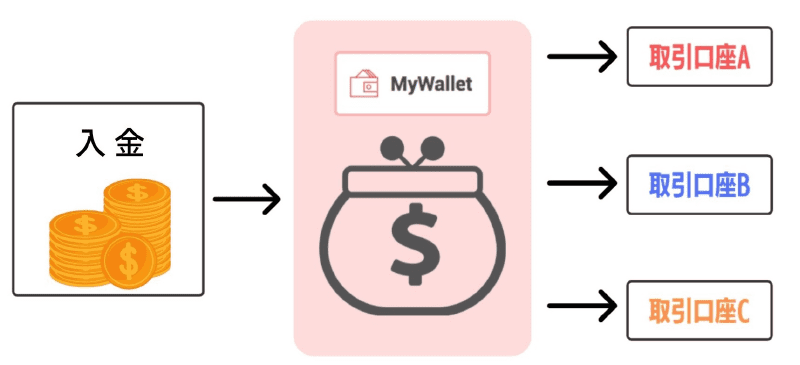

At FXCA, when you open an account, a “wallet account” will be opened at the same time. The wallet account is acted like a wallet.

The deposited funds will show up in this wallet account once, and then you can transfer the funds to the management account which can make transactions.

In order to protect personal information, SSL technology is used to protect payment process. In addition, we strive to improve the payment system quickly every day.

Currently, the available deposit methods and condition are as follows.

| Supported currencies |

Deposit Fee |

Minimum amount of deposit |

Maximum amount of deposit |

Reflection time | |

|---|---|---|---|---|---|

| Domestic Bank Remittance | JPY | Free※1 | 50USD/5000JPY | 50000USD/5000000JPY | 3 Business Day |

| Overseas Bank Remittance | USD,JPY | Free | 50USD/5000JPY | 50000USD/5000000JPY | 5 Business Day |

| Credit・ Debit Card |

Visa, Master | Free | 50USD/5000JPY | 50000USD/5000000JPY | Immediately |

| bitwallet | USD,JPY | Free | 50USD/5000JPY | 50000USD/5000000JPY | Immediately |

| STICPAY | USD,JPY | Free | 50USD/5000JPY | 50000USD/5000000JPY | Immediately |