A trading platform that enables trading of all financial instruments in the world

Login Contact Us Open Account

Open Account

FXCA uses the NDD method, which does not have a dealing desk in-house.

By strengthening cooperation with liquidity providers without performing any price fixing

We offer the lowest spreads in the industry.

With ECN account, Customers who realize the minimum spread of pips and perform scalping trade

It is a satisfactory numerical setting.

STP account spreads are standard for overseas Forex brokers,

By taking advantage of FXCA’s abundant bonuses, the real spread will be comparable to other companies.

The minimum spreads for major currency pairs in STP and ECN accounts are.

For spreads on other products, please see the trading products page.

| Transaction currency pair | STP account | ECN account |

|---|---|---|

| USDJPY | 2 pipes | 2 pipes |

| USDEUR | 2 pipes | 2 pipes |

| USDAUD | 2 pipes | 2 pipes |

| USDGBP | 2 pipes | 2 pipes |

With an ECN account, for each lot (100,000 currency) order,

A one-way 1 dollar (round trip 1 dollar) fee will be added and deducted from your trading account.

However, even if this fee is taken into consideration, the total cost can be kept lower than that of an STP account.

| Number of lots (currency) | Transaction fees | USDJPY Transaction fees |

|---|---|---|

| 0.01(1,000 currencies) | 0.2USD(2pips) | 0.2USD(2pips) |

| 0.1(1,000 currencies) | 0.2USD(2pips) | 0.2USD(2pips) |

| 1(1,000 currencies) | 0.2USD(2pips) | 0.2USD(2pips) |

| 10(1,000 currencies) | 0.2USD(2pips) | 0.2USD(2pips) |

Spread means the difference between the bid price (ASK) and the ask price (BID) offered when making a transaction.

The trader pays this difference as a commission to the Forex trader.

For example, if the bid price of USDJPY is 100.1 and the ask price is 100.2, the spread will be 10 sen.

The narrower this spread is, the more advantageous the trader can trade, so the narrower spread is a big factor in choosing a trader.

However, there is also the disadvantage that requotes and contract refusals are more likely to occur for DD companies that set low spreads.

Therefore, when choosing a Forex trader, it is necessary to check not only the narrow spread but also the trading method.

In addition, spreads fluctuate according to trading hours and market conditions, and are characterized by being easy to widen when

important indicators are announced or when the market is open or closed.

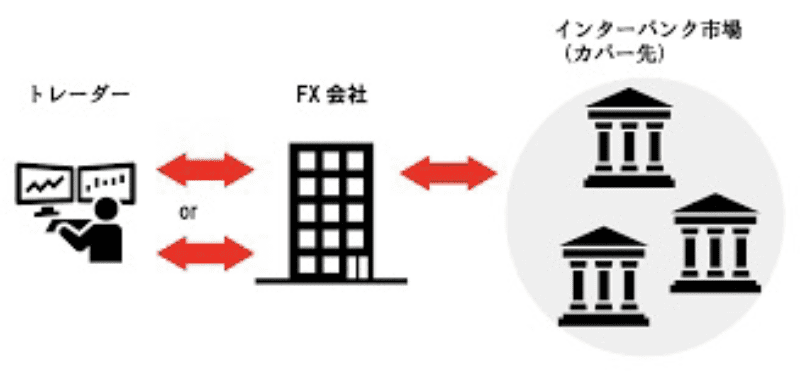

There are two types of transaction methods, DD method (Dealing Desk) and NDD method (None Dealing Desk).

FXCA uses the NDD method.

The NDD method is a method in which trader’s orders are sent directly to the interbank market.

On the other hand, the DD method is a method in which a trader intervenes between the trader and the interbank.

Most vendors in Japan use the DD method.

With the DD method, it is possible to complete trading within the company without sending the trader’s order to the cover destination.

Since there are no fees to the interbank market, we can offer traders narrow spreads.

However, the relationship between a trader and a customer is a “profit conflict” where if there is a profit on one side, a loss will occur on the other side. You can also disable it by manipulating.

On the other hand, the NDD method sends orders from traders directly to the interbank market, which inevitably

increases the transparency of transactions.

Contract refusals and requotes are unlikely to occur, and there is no conflict of interest with traders.